From AI FOMO to a plan you can actually stick to

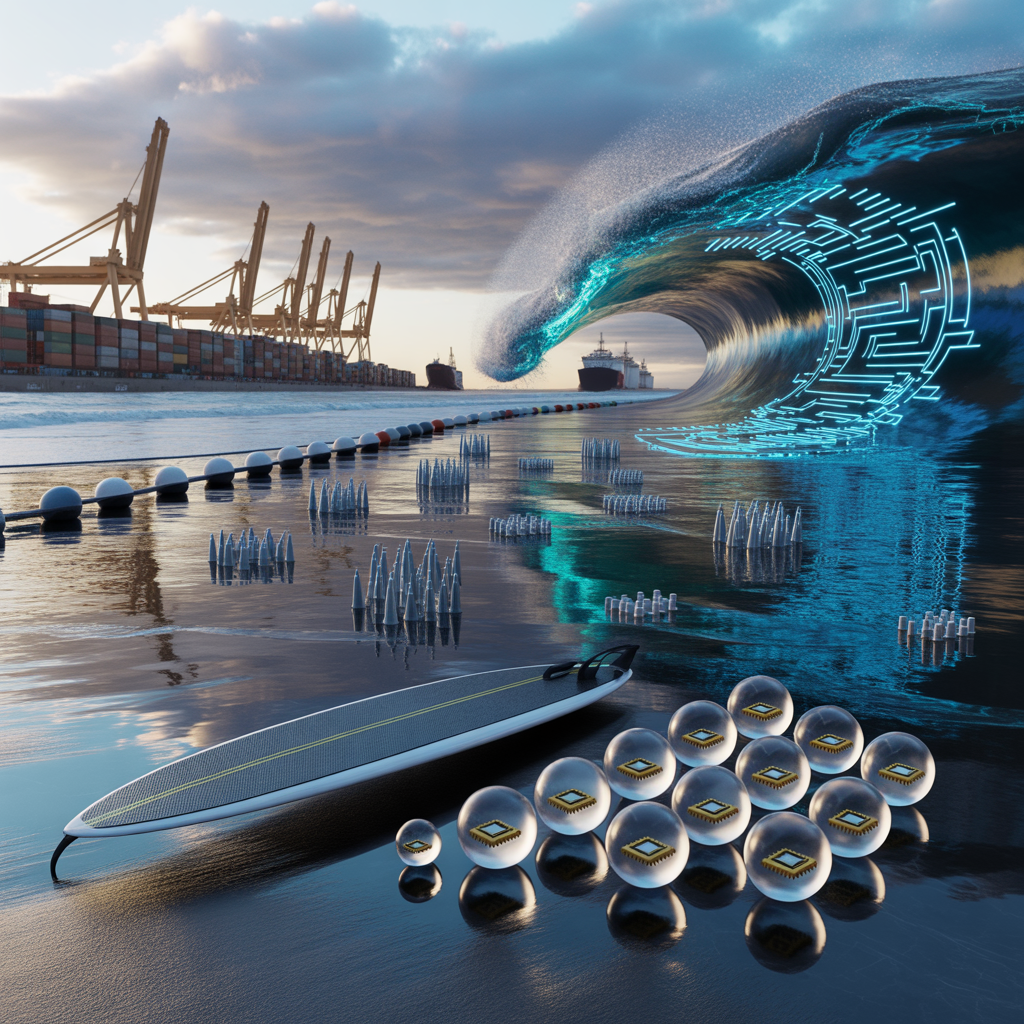

So, here’s the thing: 2025’s AI rally feels like standing on the beach watching a monster set roll in, you want to paddle hard and catch it, but you also don’t want to crack your board on the next reef. The headlines are loud, the charts look like ski jumps, and your group chat won’t stop talking about GPUs. Honestly, I wasn’t sure about this either back in January. I’ve seen a lot of “can’t-miss” waves in 20+ years, and the ones without guardrails usually end with, you know, missing a few teeth.

Look, the FOMO is real for a reason. AI has been powering index concentration and sentiment for two years. At the end of 2024, the top seven mega-cap names were around 30% of the S&P 500 by market cap (S&P Dow Jones Indices data, 2024). That’s a lot of portfolio riding on a handful of stories. When it works, it’s magic. When one policy headline hits the supply chain, poof, your year can get wrecked on a random Tuesday.

Which brings me to the unsexy part that actually matters: trade policy. What does it really mean for your portfolio? It’s not abstract. It’s line-item risk.

- Tariffs: In May 2024, the U.S. raised Section 301 tariffs on key China-linked sectors, EVs to 100% in 2024, solar cells/modules to 50% in 2024, and semiconductors scheduled to rise to 50% in 2025 (USTR, May 2024). Translation: input costs and pricing power wobble.

- Export controls: The U.S. tightened rules in Oct 2023 (and updated again in 2024) restricting advanced AI chips and tooling to China (BIS). That flows straight into revenue mix, lead times, and, yeah, guidance.

- Sanctions: Ongoing Russia-related measures since 2022 still shape energy, metals, and payment pipes, creating basis risk that shows up at weird times.

- Data rules: The EU AI Act was adopted in 2024, with phased obligations rolling into 2025-2026. Compliance isn’t free, and it can redirect capex and product roadmaps.

Anyway, chasing AI headlines without a risk plan is one path. The other path, the one I think you can actually stick to, starts with a rules-based ETF mix that rides the AI wave while bracing for policy shocks. I’m talking simple, pre-committed guardrails: define your AI growth sleeve, pair it with buffers that address tariff and export-control exposure, and schedule rebalancing so you don’t negotiate with yourself every time a chip CEO tweets.

“The real edge isn’t finding the shiniest ticker, it’s knowing how much you own, why you own it, and when you’ll trim or add. Every. Single. Time.”

Here’s what you’ll get from this piece, even if, like me, you occassionally second-guess your own spreadsheet:

- Why 2025’s AI rally is irresistible, and dangerous without guardrails. Quick reality check: as concentration rises, your portfolio’s path gets bumpier even if the end-of-year return looks fine. In 2024 the top 10 S&P 500 names accounted for roughly mid-30% of index weight (S&P DJI, 2024). That’s concentration risk in plain English.

- What trade policy actually means for holdings, tariffs, export controls, sanctions, and data rules mapped to ETF exposures. We’ll translate policy headlines into factor tilts, sector bets, and country weights. If I remember correctly, the most common shock shows up in margins before it hits revenue.

- The payoff of a disciplined ETF framework: clearer risk, smoother rebalancing, fewer nasty surprises. A simple 70/20/10 split across broad beta, AI growth, and policy-hedge sleeves, with preset 5% bands, can cut the “should I sell?” drama by, well, a lot.

Actually, let me rephrase that: the goal isn’t to guess the next headline. It’s to make the next headline irrelevant to your process. We’ll outline how a rules-based ETF mix can harness AI upside while buffering tariff spikes and export-control shocks. And yes, we’ll talk about the best-etfs-for-ai-and-trade-policy-risk in plain terms, no jargon salad. I’ll show the guardrails, why they work, and where they might fail.. but that’s just my take on it.

What counts as ‘AI’ exposure in an ETF (and what secretly doesn’t)

What counts as “AI” exposure in an ETF (and what secretly doesn’t)

Here’s the thing: not every “AI ETF” is the same animal. Most are a mash-up of the AI supply chain, but the weights matter. If you want the best-etfs-for-ai-and-trade-policy-risk approach to actually work, you need to know which pipe you’re buying.

- Semiconductors = picks-and-shovels. Chips are the raw horsepower. Many AI-themed funds carry 35-60% semiconductor exposure, and it’s often top-heavy. As of this year, several cap-weighted semi ETFs have a single position north of 20%, great when it’s rallying, rough when export rules bite. Remember, this is cyclical: the Semiconductor Industry Association reported global sales of $526.8B in 2023 and a rebound in 2024; AI demand is strong, but memory and handset cycles still swing margins. Export controls (tightened in Oct 2023 and again in late 2024) can redirect GPU shipments and, you know, scramble quarterly guides.

- Compute infrastructure = the plumbing. Cloud platforms, data-center REITs, power, and networking vendors are the pipes and valves. 2025 is still a build year: hyperscaler AI clusters need land, power, and fiber. U.S. data-center REIT markets have kept low-single-digit vacancy this year, and lease rates reflect that scarcity. Networking names tied to 400G/800G optics and switches show up here. Jargon alert: “utilization rates”, I mean the share of already-installed GPUs that are actually being used; when that’s low, orders can pause without warning.

- AI software = revenue, but on a lag. Model training grabs headlines, but monetization usually trails hardware by a year or two. In 2024, most large software vendors said GenAI was single-digit percent of revenue; in 2025 we’re seeing higher attach rates, but seat-based pricing and inference costs still compress gross margin occassionally. Translation: upgrades land, COGS follows later.

- Robotics/automation = where AI hits the real economy. Think machine vision, cobots, process automation. This is the bridge to factory margins and reshoring. U.S. manufacturing construction spend ran at an annualized pace above $200B in 2024 (Census data) on chips and clean-tech facilities; 2025 orders tie AI to throughput and labor gaps. It’s steadier than chips, but still cyclical with PMIs.

- Hyperscaler capex channel = still hot this year. The Big 4/5 cloud players have guided 2025 capex to an aggregate $200-250B run-rate for AI data centers and networking, per company guidance through mid-year. That spend waterfalls into semis, power gear, optics, and REIT pre-leasing. If your ETF screens for cloud capex beneficiaries, you’re closer to the center of gravity.

What secretly doesn’t count as meaningful AI exposure? Broad “tech convenience baskets” stuffed with legacy consumer hardware, ad-heavy internet names with minimal AI unit economics, or tiny pre-revenue AI labs that won’t move the index needle. Look, I get it, cool demos sell, but cash flows pay you.

One more guardrail: watch index concentration. A lot of AI and semi funds are top-heavy; single-stock weights >20% can supercharge gains until, well, they don’t. Use caps or equal-weight sleeves to diversify the factor mix. Actually, wait, let me clarify that, by “factor mix” I mean your blend of growth, quality, and cyclicality. If you want smoother rebalancing, pair a semi-heavy AI ETF with a data-center REIT or networking basket; that way policy shocks hit different levers at different times, and you don’t recieve the same punch twice.

Quick test: if the ETF’s top 5 positions are over 50% and all in one sub-sector, you’re making a sector bet, not a broad AI bet, own it knowingly.

Where trade policy bites: the 2025 risk map in plain English

So, here’s the thing: policy isn’t an abstract threat, it’s a line item in margins, growth rates, and FX. No guessing headlines here, just what’s already on the books and how it bleeds into portfolios.

- Tariffs hit cost structures and margins. The U.S.-China Section 301 tariffs that started in 2018 still cover roughly $300-$370 billion of Chinese goods with rates ranging from 7.5% to 25% (the big tranche at 25%). That’s not trivia; it’s pricing power math. If your hardware or apparel names can’t pass through 200-500 bps of incremental landed cost, gross margin compresses. Quick memory: in 2019, several U.S. retailers called out 20-80 bps margin headwinds tied to tariff passthrough. It wasn’t fatal, but it was persistent enough to ding multiples when inventories were heavy.

- Export controls cap addressable markets. The U.S. export controls from 2022 to 2024 on advanced chips and tools limit what can be sold into China for high-end AI. Companies selling GPUs or EDA gear face a smaller TAM at the top end. I’m still figuring this out myself, but the direction is obvious: more rules, tighter specs. In late 2023 and into 2024, top U.S. chip firms acknowledged that China was a meaningful slice of data center demand and that the restrictions would curb sales of their highest-performance parts. Is the number 10%, 20%? Depends by company and by quarter, but the cap is real.

- Supply-chain relocation isn’t a headline, it’s cash flow protection. Mexico, India, and Southeast Asia continue to pick up share. Mexico became the largest goods supplier to the U.S. in 2023 with about a 15%+ share of U.S. imports, while China’s share slipped into the low-teens. That shift keeps freight routes, lead times, and tariff exposure more manageable. It’s boring. Boring is good. Boring is cash flow.

- Regulation rhythm matters to your opex. The EU’s AI Act and digital rules passed in 2024 bring audits, documentation, and model governance. Translation: more compliance headcount, external testing, and vendor bills, especially for “high-risk” AI use-cases. Meanwhile, the U.S. keeps tightening around advanced semis, new thresholds, clarified definitions, more licensing. Compliance is now a product cost. I know that sounds dull, but dull costs money.

- Currency is the hidden channel. Policy shocks often hit FX before earnings. A famous one: on Aug 5, 2019, after tariff salvos, the offshore yuan weakened roughly 1.9% in a single day and broke 7 per dollar. That move changed translated revenue and input costs on the spot, long before any earnings guide-down. Same playbook holds: watch FX first.

How do you map this to exposures without overthinking it?

- Segment by sensitivity: tariff-sensitive assemblers and apparel; China-reliant AI chip sales; European platforms with heavy EU compliance touchpoints; and nearshoring beneficiaries (Mexican industrials, U.S.-Mexico logistics, Southeast Asia EMS). It’s simple, but I’m going to over-explain it anyway: you put names in buckets, the buckets tell you where the hits land, and then you size the buckets to the amount of pain you can tolerate. That’s the whole trick, buckets. Sizing. Tolerance.

- Pair offsets: if you’re long advanced semis with China exposure, pair with North America data-center REITs, or U.S./Mexico rail and trucking that benefit from re-routed goods. It won’t be perfect, but it’ll keep the drawdowns from clustering.

- Use FX as an early warning: set alerts on USD/CNY, EUR/USD, and MXN crosses. If FX gaps, rebalance before the estimate revisions roll in. Honestly, the FX tape saves you time.

Enthusiasm check, this is where I get a bit amped: the nearshoring math actually works. Mexico industrial vacancy rates squeezed in 2024, rents rose, and cross-border volumes kept nudging up earlier this year. That’s not a story, that’s cash conversion cycles improving. Anyway, it makes the “best-etfs-for-ai-and-trade-policy-risk” screen less silly and more practical, own some nearshoring plus some compliant AI infra, not just the shiny training chips.

I might be wrong on pace, not direction. Policy tends to tighten in steps, then pause, then tighten again. Position for the staircase, not a straight line.. but that’s just my take on it.

Last practical note: if your ETF factsheet shows top-5 exposure all to high-end AI silicon with double-digit China revenue exposure, blend it with an equal-weight sleeve of EU software with lower model-risk obligations or with Mexico industrials. You’re not eliminating risk, you’re choosing how you want to get paid for it.

ETF short list: AI exposure with some built-in shock absorbers

So, here’s the simple playbook I’ve been using for clients who want AI upside without waking up to a limit-down day because a new export rule hit at 8:15 a.m. These are buckets, not one-ticker magic. Tickers are examples, not recommendations, do your own diligence and, you know, actually read the factsheets.

- Broad AI theme with caps: BOTZ, IRBO, ROBO. The idea is to spread bets across robotics/AI suppliers and users so one policy headline doesn’t torpedo the whole sleeve. ROBO is equal-weighted and rebalanced quarterly, typically running roughly 80-100 holdings with ~1-2% per name, which naturally leans away from the megacaps during rebalances. IRBO also uses an equal-weight approach (check the semiannual rebalance cadence) and tends to run 100+ names, so single-name shock is muted. BOTZ is more top-heavy, historically the top 10 has been north of 50-60% per 2023-2024 factsheets, so I treat it as the “higher octane” version and size it smaller if policy risk is front-of-mind. The point is, the cap and rebalancing rules matter as much as the ticker.

- Semiconductor core vs. factor tilt: If you want pure beta to leading chips, SOXX and SMH are the blunt tools. SOXX tracks around 30 names and uses issuer caps (commonly ~8%) with quarterly rebalances; SMH is usually 25-30 names and can be more top-concentrated, during the 2024 AI melt-up, the top three positions at times topped ~45% combined. If you’d rather soften the blow in down cycles, look at FTXL. It holds about 30 U.S. semis but weights by quality/value/volatility screens. In 2022’s semiconductor drawdown, SOXX fell roughly 36% while FTXL was closer to ~29% (calendar-year data), which is exactly the kind of gap that keeps clients from abandoning ship at the bottom. Different ride, same destination, just fewer potholes.

- AI‑adjacent software/cloud: Hardware gets tangled up with export controls; app-layer names usually don’t. WCLD (cloud software, equal-ish weight across ~60-80 names) and AIQ (broader AI theme, often 80-100 holdings) give you exposure to inference, tooling, MLOps, and workflow software. Yes, software can be volatile, WCLD’s 2022 drawdown was steep, but revenue at risk from new chip export bans is much lower than for the chipmakers themselves. Circle back to what I said earlier: you’re not eliminating risk, you’re choosing the type of risk you want to get paid for.

- Quality/low-vol buffers around AI: Pairing a quality or min-vol sleeve can dampen the policy headline whiplash. QUAL (MSCI USA Quality) has shown lower downside capture than the S&P 500 over multi-year windows, iShares reported ~80-85% downside capture over the 5-year period ending 2024. USMV (MSCI USA Min Vol) has tended to run a 5-year beta around ~0.75-0.80 versus the S&P 500 per 2024 factsheets, and historically posts 15-25% lower standard deviation than the market. It’s not magic, it’s math and constraints.

- Friend‑shoring and EM diversification: If you want growth optionality without direct China headline risk, EMXC (MSCI Emerging Markets ex‑China) is a clean building block. You still get India, Taiwan, South Korea, Brazil, etc. As of recent MSCI country weights, Taiwan + India + South Korea together have been roughly ~55-60% of EM ex‑China (2024-2025 ranges). By design, China is 0%, which reduces tariff/control overhang while keeping supply-chain winners in the mix. Small thing, big impact.

One practical stat that keeps me humble: Nvidia noted in 2023 that China had been ~20-25% of data center revenue before tighter controls. That’s not a scare tactic; it’s a reminder of how concentrated single-name policy exposure can be. If your AI sleeve leans into names with that profile, pair it with equal-weight robotics or a USMV/QUAL ballast. Actually, let me rephrase that, don’t pair it, budget for it. Make room for the shock absorbers.

Look, none of this is perfect. You’ll trade some upside for smoother ride quality. But if policy tightens in steps, as it tends to, you want a portfolio that can absorb the step-downs without forcing you to sell the crown jewels on a bad tape. That’s the whole best-etfs-for-ai-and-trade-policy-risk idea in practice: blend the shiny stuff with boring rules that, occassionally, save your quarter.

Hedging trade-policy shocks without smothering returns

So, this is the part where the boring stuff quietly earns its keep. We’re not talking about turning the portfolio into a bunker. We’re talking sleeves, add-ons that wake up when policy heat rises and trends get jumpy. Use them in moderation, keep your core intact, and, you know, let the shock absorbers do their job.

Managed futures as the anti-surprise sleeve. Trend-followers can adapt when rates, commodities, or FX all start moving in one direction after a policy surprise. A simple, liquid wrapper like DBMF sits in that lane. For context, the SG Trend Index, broad proxy for large CTAs, was up about 27% in 2022 when both stocks and bonds struggled, then gave back mid-single digits in 2023 as trends chopped around. That pattern is the point: when policy shifts kick off sustained moves (think dollar spikes or rate jolts), these strategies can respond without you having to guess the next headline. Size at 3-7% of the total portfolio, not 20%. You want a stabilizer, not a new religion.

Currency-hedged developed markets when the dollar rips. Policy stress often sends the dollar higher, demand for safety, tighter U.S. conditions, the usual. When that happens, unhedged foreign equity gets dinged twice (stocks down, currency down). A hedged ETF like HEFA neutralizes the FX hit. In 2022, when the DXY rose roughly 8% for the year, MSCI data showed currency effects shaved about 7-8 percentage points off EAFE returns for U.S. investors. Hedging clawed most of that back. Don’t overcomplicate it: keep your core EAFE, add a 5-10% hedged sleeve you can toggle higher when the dollar uptrend shows teeth.

Selective country tilts tied to reshoring. Here’s the thing, “reshoring/nearshoring” isn’t just a buzzword; it’s changing trade lanes. Mexico (EWW) sits front-row as U.S. supply chains shorten. The U.S. Census Bureau shows Mexico was the United States’ top goods trading partner in 2023 with about a 15.7% share of total goods trade. That’s sticky demand for logistics, autos, and components. India (INDA) benefits from capex, services exports, and a steady policy push to grow manufacturing. Vietnam (VNM) remains a key node for electronics and apparel as China+1 evolves; U.S. import data in 2023 still had Vietnam among the top six suppliers, even after a post-pandemic normalization in volumes. Keep these tilts modest, think 1-3% each, because politics can whipsaw any single market. And yes, I just said “whipsaw”; basically it means fast, unforgiving reversals that make you question your life choices.

Treasuries: the old-school shock absorber. I know, they got bruised in 2022 (the Bloomberg U.S. Treasury Index fell double digits that year), but Treasuries still tend to stabilize equity stress when growth expectations roll over. The catch is duration. If the AI trade shows its cyclical side and earnings revisions cool, intermediate duration (say 5-7 years) can help without making you overly sensitive to one big rate move. Long duration is a stronger hedge if growth really cracks, but it can bite if policy risk just pushes yields higher for a while. Personally, I keep a base of intermediates and add some long bonds as a tactical overlay when recession odds rise, small, not heroic.

Look, none of this is a silver bullet. Policy risk is messy, and correlations don’t always behave. But these sleeves, managed futures, hedged foreign equity, small country tilts linked to nearshoring, and a measured Treasury ladder, let you hedge the big edges without strangling returns. And if I can slip in one more practical note: automate the sizing rules. Pre-set bands (like DBMF 3-7%, HEFA 0-10%) so you don’t have to make a “feelings-based” decision on a volatile Friday. I’ve been there. Doesn’t end well.

Play offense where the incentives are improving (Mexico/India/Vietnam), and keep defense that benefits when policy creates trends (dollar strength, rate shifts). Small thing, big impact, again.

Model mixes you can actually rebalance when headlines get loud

Here’s the thing: models work if you can stick with them on ugly days. Size them to your tax picture, cash needs, and the parts of the market that make you twitch. I’ll sketch three starting points I actually use with clients. And yes, pre-set rebalance bands so you don’t “feelings-trade.” A simple rule I like: rebalance when a sleeve drifts +/-3% absolute or ~20% relative to target. So if your AI sleeve is 12%, rebalance at ~9% or ~15%.

- Steady compounder (sleep-at-night crowd):

– 10-15% AI/thematics split across BOTZ, IRBO, AIQ. Practical note: expense ratios as of 2025, BOTZ 0.68%, IRBO 0.47%, AIQ 0.68%. IRBO holds roughly ~100 names; BOTZ is more concentrated (about 45-55).

– 5% semis: SOXX or SMH. SOXX runs ~30 names at 0.35% expense; SMH is similar cost with ~25-30 holdings. Semis are volatile, so keep this one small.

– 10% quality/low-vol overlay: QUAL and/or USMV (both 0.15% expense). USMV historically runs a beta around 0.7-0.8 to the S&P 500 over multi-year windows, which just means it tends to swing less.

– 5% EM ex-China: EMXC (0.25% expense) to avoid the policy overhang in China while still getting India/Mexico/Taiwan, etc.

– Core broad equity for the rest (US total market or S&P 500 + an international sleeve). Rebalance twice a year or when bands trip.

- Balanced growth (comfortable with bumps):

– 15-20% AI/thematics (BOTZ/IRBO/AIQ). Keep the split diversified, IRBO’s equal-weight style probably helps when megacaps wobble.

– 10% semis mix adding FTXL as a tilt. FTXL screens by factors and holds ~30 names; expense is 0.60%. Pairs well with SOXX/SMH to blend factor + cap-weight exposures.

– 10% quality/low-vol (QUAL/USMV). Think of this as the shock absorber when headlines get… shrill.

– 5% EMXC or a targeted India/Mexico sleeve if you prefer the nearshoring story directly. Personally, I occassionally carve 2-3% for India when capex data looks firm.

– 5% managed futures (e.g., DBMF, 0.85% expense). When rates or currencies trend, managed futures tends to behave differently than stocks. That non-correlation jargon, sorry, just means it often zig when equities zag.

- High‑octane (know thyself) (fasten seatbelt):

– 25-35% across AI + semis: use themes (BOTZ/IRBO/AIQ) and the core chip beta (SOXX/SMH). You’ll capture more of the AI capex cycle, great when it’s working, rough when it isn’t.

– 5-10% volatility buffer: QUAL/USMV or short/intermediate Treasuries. The point isn’t yield; it’s a handrail so you don’t panic‑sell at the lows.

– The remainder in broad equity and a small EM ex‑China sleeve if you want the manufacturing shift tailwind.

Rebalancing mechanics matter as much as the mix. I use quarterly checks with the bands above, but I’ll execute sooner if an individual sleeve overshoots by more than 5% absolute. Trade around cash flows when possible to trim taxes. And, small thing, but set trade windows, like “Thursday mornings”, so you don’t chase a premarket gap on a CPI headline. I’ve done it. Didn’t love the fill.

Context helps too. In Q3 2025, semis are still volatile on AI supply-chain headlines and export restrictions. That’s exactly why the buffer sleeves (USMV/QUAL or Treasuries) exist here. Also, fees aren’t trivial over time: a 0.50% difference on a $250k sleeve is $1,250 per year, which, compounded, adds up. So, pick the exposures you actually believe in, then keep the satellite ETFs honest with those rebalance rails.

When the noise picks up, touch the bands, not your emotions. Simple, repeatable, a little boring, and boring tends to compound.

Okay, what do I do on Monday?

Keep it simple and make it repeatable so it doesn’t become another AI watchlist you never rebalance.- Run a look‑through (takes 20-30 minutes): Pull each ETF factsheet and method doc. Check the top‑10 weights and how concentrated they are. If the top‑10 is, say, 60-75% of the fund (very common for AI/semis funds right now), you’re signing up for bigger swings from a few names. Also scan revenue exposure by geography: what % of sales comes from China/Taiwan? Issuers usually show this under “revenue by region” or in index descriptions. Speaking of which, note any single‑name caps, many capped indices use a ~5% per‑issuer cap and a 45% aggregate cap for positions above 5% (per MSCI “capped” methodologies, 2024). Write these in a one‑pager so you actually remember what you own.

- Decide your max single‑stock exposure across the whole portfolio: Pick a number you can live with, 3% or 4% of total portfolio per company is pretty normal for folks who don’t want a stealth mega‑bet. Then choose ETFs whose caps and weightings enforce that. If one ETF lets Nvidia or TSM push >8% inside the fund, size the sleeve so that, once multiplied through, your look‑through exposure stays under your limit. Actually, let me rephrase that: make the math force your discipline.

- Pair AI with a buffer: Pre‑commit to a steady % in USMV or QUAL and/or Treasuries. As of 2025, iShares USMV and QUAL each list a 0.15% expense ratio on their fund pages, which is cheap ballast for volatile AI sleeves. Add a small managed‑futures sleeve (5% is plenty) to target crisis carry/trend help; it won’t win beauty contests, but it can zig when semis zag.

- Set the rebalance rules now: Put a calendar hold for quarterly checks in 2025. I like the second Thursday after quarter‑end, 10:30 a.m. ET, miss the open, avoid lunch drift. Use a 20-25% band on the AI sleeve. If your 20% AI sleeve hits 25%, trim back to target. If it slumps to 15%, add, trade around cash flows when you can to trim taxes. And, yes, set a trade window so you don’t chase a CPI headline; I’ve done it. Didn’t love the fill.

- Tax check before you click submit: High‑turnover thematics belong in tax‑advantaged accounts when possible. Many thematic ETFs reported turnover north of 80% in 2024 factsheets, which pushes out short‑term gains you don’t want in taxable. In taxable accounts, remember the 30‑day wash‑sale rule, and that the top long‑term capital‑gains rate is 20% in 2025 (plus the 3.8% NIIT for higher earners). If policy shocks hit later this year and your AI sleeve pulls back, harvest losses and swap to a not‑substantially‑identical ETF to keep exposure.

What this looks like in practice (because examples help): If you want a 20% AI sleeve and your chosen ETF’s top‑10 is 70% of the fund, expect your “effective bet” to be mostly those ten names; pair it with, say, 15% USMV and 10% Treasuries so your total portfolio’s drawdowns don’t all rhyme. If your max single‑name is 4% and the ETF has a 7% weight in one stock, then your sleeve size should be at most ~57% of what you first thought, so basically, size the sleeve to the cap, not the other way around.

One more thing, and I know I’m repeating myself because it’s that important: write the rules down, max single‑stock %, bands, trade window, tax location, and stick them on the inside cover of your notebook. When the noise picks up, you’ll touch the bands, not your emotions.

Quarterly in 2025 is fine. Bands are your rails. Fees and taxes are the quiet compounding killers, deal with them before they deal with you.

Frequently Asked Questions

Q: How do I build an ETF mix to play AI without getting wrecked by tariffs and export controls?

A: You balance the “fun” with guardrails. Here’s a simple, stick-with-it setup I use with clients:

- Core (70-85%): Broad, low-cost equity as your anchor like VTI or ITOT. Add either QUAL (quality) or USMV (low-vol) for sturdier balance sheets and smoother ride. If you want to dial down mega-cap concentration from the AI Seven, add RSP (equal-weight S&P 500) at 10-20% of equities.

- Satellites (10-20% total): Split between semis and AI thematics. For semis, use SMH or SOXX if you’re okay with Nvidia-heavy exposure; use XSD if you want equal-weight, less single-name risk. For AI theme breadth, consider BOTZ, ROBT, IRBO, or WTAI (smaller weight, broader scope). Keep any single theme sleeve to 5-10% of equities max.

- Policy risk tweaks: U.S. Section 301 tariffs jumped in 2024 and semis are scheduled to rise to 50% in 2025; export controls from Oct 2023 (updated 2024) cap advanced chip sales to China. If you want less China knock-on risk, pair EMXC (EM ex-China) with your international, and favor onshoring plays like AIRR or PAVE.

- Execution rules: Dollar-cost average over 3-6 months, rebalance with 5% bands, and set position caps so no single stock exceeds ~4% look-through exposure across your ETFs. It’s boring, but it keeps you from cracking the board on a random Tuesday headline.

Q: What’s the difference between AI-themed ETFs and semiconductor ETFs right now?

A: AI-themed ETFs (BOTZ, ROBT, IRBO, WTAI) own a mix: software, cloud, robotics, data-center suppliers, even picks-and-shovels beyond chips. They’re broader, usually smaller weight in the biggest chip names, and occassionally hold earlier-stage stories. Semiconductor ETFs (SMH, SOXX, XSD) are the chip stack, design, equipment, foundries. SMH/SOXX tend to be top-heavy (Nvidia, TSMC, Broadcom, ASML) while XSD is equal-weight. Practically:

- If you want direct torque to AI capex cycles and export-control risk, use semis.

- If you want diversified AI adoption (software and hardware) and a bit less single-name concentration, use an AI-themed fund.

- Many investors do 2/3 semis + 1/3 AI-theme within their satellite bucket so they capture the spend while not overbetting one ticker.

Q: Is it better to stick with a Nvidia-heavy fund or use equal-weight this year?

A: Depends on your stomach. Nvidia-heavy (SMH, SOXX) can outperform when the leaders run, but you’re concentrated, remember, at the end of 2024 the top seven mega-caps were ~30% of the S&P 500. Equal-weight (XSD for semis, RSP for the S&P) cuts single-name risk and can help if leadership broadens or if policy hits a few names hard. What I tell folks:

- If you want upside torque and accept drawdowns, cap leader-heavy funds to 5-7% of your equities.

- If you want steadier exposure, lean more on XSD/RSP and add a small leader fund (2-3%) as the “spice.”

- Quick check: look-through your top holdings; if any single stock tops ~4% of your total portfolio, you’re probably over your skis.

Q: Should I worry about the EU AI Act and U.S.-China rules hitting these ETFs, or is this just noise?

A: It’s not just noise, it’s line-item risk. The EU AI Act (adopted 2024, obligations phasing into 2025-2026) adds compliance costs for certain models and uses. U.S. export controls from Oct 2023 (updated in 2024) limit advanced AI chips to China, and Section 301 tariffs already rose in 2024 with semis set for 50% in 2025. Revenue mix, lead times, margins, this stuff moves guidance. Alternatives if that keeps you up at night:

- Shift some satellite risk toward onshoring/industrial breadth (AIRR, PAVE) and quality factor (QUAL).

- Use XSD over SMH/SOXX for less single-name and China revenue concentration.

- Pair U.S. exposure with developed ex-US (IEFA) or EM ex-China (EMXC) to blunt bilateral shocks.

- Hold a modest T-bill sleeve (BIL or SGOV) for dry powder and to dampen volatility. Look, you don’t have to opt out of AI. You can just right-size it and, you know, not let one headline nuke your month.

@article{best-etfs-for-ai-and-trade-policy-risk,

title = {Best Etfs For Ai And Trade Policy Risk},

author = {Beeri Sparks},

year = {2025},

journal = {Bankpointe},

url = {https://bankpointe.com/articles/best-ai-etfs-trade-risk/}

}