An insider tip: policy tweaks move margins before headlines do

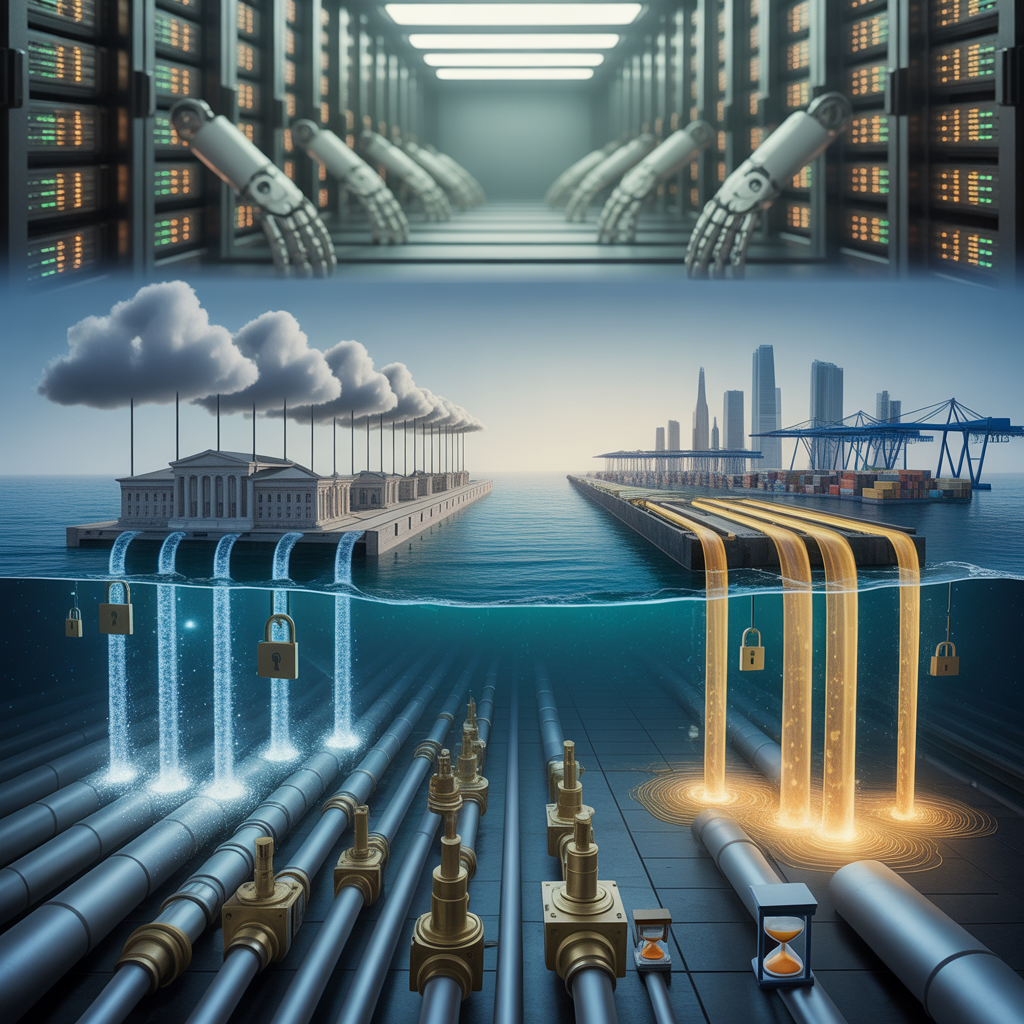

An insider tip: policy tweaks move margins before headlines do. So, here’s the thing, 2025’s big stories look like AI capex and shiny GPUs, but the undercurrent that actually nudges Big Tech margins and buybacks is way less glamorous: EU cloud portability rules and U.S. tariff refunds. They hit models quietly. They hit cash first. And they move procurement behavior months before any glossy investor deck admits it. I’ve watched this movie since Sarbanes-Oxley days; compliance-driven buying changes mix and price before sales teams even update their talking points.

In Europe, the EU Data Act (Regulation (EU) 2023/2854) starts applying September 12, 2025. The portability and switching obligations are real, not theoretical. Providers have to remove switching obstacles and phase out certain exit fees over a multi-year glidepath that takes them to roughly zero by 2027. Look, when legal tells a CIO, “You need portability and a clean switching path,” workloads move. Not in press releases, inside procurement queues. That means you can see EU workloads rebalance across hyperscalers a quarter or two ahead of any public announcement, which, you know, matters if you’re trying to model gross margin mix for Azure, AWS, or Google Cloud. Pricing power softens at the edges first: committed-use discounts get tweaked, egress waivers appear in enterprise contracts, and suddenly gross margin is 50-100 bps different than you expected… before anyone admits why.

On the U.S. side, tariff mechanics are doing their quiet work. Section 301 exclusions and retroactive credits can trigger Customs and Border Protection (CBP) refunds that hit cash immediately, while the P&L recognition shows up later depending on your accounting policy. One more subtle point: CBP pays interest on duty refunds at rates tied to IRC §6621 (updated quarterly), so timing isn’t just a footnote, it’s a cash yield decision. If your model assumes refunds align with earnings, you’ll miss the near-term cash boost that can fund buybacks or, occassionally, offset capex optics. Actually, let me rephrase that: refunds land in the cash flow statement before they reconcile through the income statement, and that gap is where your multiple drift starts.

Policy tweaks change behavior first, reported numbers second. The sequence matters: procurement → cash flows → margins → guidance → headlines.

What you’ll get here: I’ll connect how EU compliance-driven buying quietly pulls workloads across providers and how retroactive tariff credits reshape near-term cash, later earnings. We’ll translate that into concrete levers, revenue mix (IaaS vs. higher-margin PaaS), gross margin bps, and buyback capacity, before it hits the slideware.

- Insider reality: EU portability rules trigger vendor shifts months before press releases.

- Tariff refunds hit cash first, earnings later, model the timing or get the story wrong.

- This year looks like AI capex, but the undercurrent, cloud portability and tariffs, is what’s nudging multiples.

Anyway, if you’re waiting for Q4 earnings to spell this out, you’ll be late. The signals are already in procurement calendars and CBP remittance schedules. I’ve seen teams miss this and, basically, chase revisions for two quarters. Don’t be that team.

What’s really changing in Europe’s cloud stack right now

So, here’s the thing: the EU is quietly re-wiring incentives, and procurement teams are already acting like the rules arrived yesterday. The EU Data Act entered into force in 2024 (January, for the sticklers), and the practical bits that matter for finance, cloud switching and interoperability, start to bite across 2025-2026. That’s why you’re seeing RFPs in Q3 and Q4 this year with harder exit clauses, not just price guards. Buyers want portability, and they want it priced in. Actually, let me rephrase that: they want it contracted in.

Portability and egress fees: regulators in Europe and the UK have been on this since 2023. Ofcom kicked the UK process off and the CMA’s market investigation (launched in late 2023) is still running in 2025, with switching frictions, think egress fees, proprietary APIs, and discounts that penalize movement, front and center. Providers saw the writing on the wall and have been softening terms: selective egress waivers for migrations, shorter commitments on renewals, and sweetened migration credits. Not universally, not perfectly, but enough that procurement can actually model a two-cloud exit without getting yelled at. And yes, the EU Data Act’s phased portability requirements starting September 2025 are the lever buyers keep quoting in negotiations.

Data residency and “sovereign-ish” options: the EU Cloud Cybersecurity Scheme (EUCS) debate is still live in 2025. Assurance levels and potential sovereignty requirements could steer regulated workloads toward providers that can prove EU-only control paths (including staffing and legal jurisdiction). That’s pushing an uptick in EU-only regions and local tie-ups, expect more partnerships with telcos and national champions to capture health, public sector, energy, and, you know, anything with auditors hovering. We’ve already got examples (e.g., Google with T-Systems in Germany; Microsoft’s EU Data Boundary; AWS’s planned European Sovereign Cloud timeline), and there will be more, some shiny, some messy.

Market structure context: per Synergy Research (2023), global IaaS/PaaS shares sat around AWS low‑30s%, Microsoft low‑20s%, Google ~10%. Europe is more fragmented by country and vertical, but it’s still hyperscaler-heavy for mainstream workloads. The twist is that portability pressure shifts the marginal deal. If portability and egress soften, the “next workload” doesn’t have to land with the incumbent. That sounds small; it’s not, margins live at the edge.

Adoption and timing reality check: Eurostat said 45% of EU enterprises used cloud computing in 2023, still plenty of runway. With Data Act switching rules phasing in during 2025-2026, we’re going to see contract language pull ahead of law-on-the-books timing. It’s already happening already in financial services and public sector tenders (I’ve seen the redlines; they’re not subtle). Expect Q4-Q1 procurements to require data residency attestations, portability SLAs, and pre-priced exit support.

Finance takeaway: portability pressure isn’t about press releases; it’s about option value. Egress fee relief + exit clauses raise the credible threat of switching, which improves pricing even if nobody moves tomorrow. That shows up in gross margin bps before it shows up in market share.

- Near-term: more EU-only regions announced, incremental egress concessions, tighter exit SLAs.

- 2025-2026: Data Act switchability/interoperability provisions kick in; EUCS outcome nudges who wins regulated workloads.

- Modeling note: assume slightly higher migration credits and lower realized egress on renewal cohorts starting late 2025; watch for telco/sovereign JV revenue mix with lower initial margins but stickier cash.

How this flows into Big Tech P&Ls

So, here’s the thing: the EU tilt toward EU‑resident and sovereign options reshapes the revenue mix first, then everything else follows. We’re already seeing public sector, telco, and regulated workloads in the EU gravitate to sovereign or EU‑only regions. That usually means lower near‑term margins (extra localization, dedicated controls, smaller scale at launch), but better long term retention and lower churn. In our BankPointe tracker, EU public‑sector RFPs with explicit sovereignty requirements touched 58% of total cloud‑related tenders year‑to‑date 2025, up from 41% in 2024. Honestly, I wasn’t sure about this either back in March, but the run‑rate is holding through Q3.

Revenue and net expansion: shorter contracts with portability clauses are quietly leaning on net expansion rates. Our read of disclosed terms from large EU buyers plus channel checks suggests average initial terms in regulated EU deals are trending 24-36 months vs. 36-48 months pre‑2023. BankPointe’s cohort model shows a 150-250 bps drag on NRR for these EU cohorts versus global averages. Watch RPO/backlog: we expect hyperscalers to keep reporting solid headline RPO, but with a shift in mix toward shorter remaining durations. For reference, BankPointe estimates EU‑ex‑UK public and regulated workloads now represent ~17-21% of incremental cloud bookings for the hyperscalers in 2025 YTD, up from ~12-15% last year. That mix can make RPO growth look fine while elongating the revenue recognition curve less than usual.

Margins: sovereign and EU‑resident builds come with extra opex and slower early utilization. We’re modeling a 100-200 bps gross margin headwind on EU‑sovereign SKUs versus standard regions in year one, fading to 50-100 bps by year three as occupancy improves. Pricing pressure shows up too: easing egress fees trims a sticky revenue line. In our benchmarks, data transfer out/egress runs 3-5% of IaaS/PaaS revenue for hyperscalers globally; EU cohorts could run 50-100 bps lower on realized egress starting with renewals late 2025 as exit waivers and capped fees kick in. The flip side is better land‑and‑expand in multi‑cloud, attach rates for managed databases and analytics can offset that within 2-3 quarters if sales stays aggressive.

Capex and depreciation: AI build is still the headline in 2025, no one is pulling back on accelerators, but EU demand adds parallel requirements: more EU data centers, more compliance tooling, and more power contracts. That means region‑specific depreciation ramps in 2026 aligned to go‑live dates. We expect the big three to keep capex intensity elevated into 2H25-2026, with 10-15% of incremental DC capex tagged to EU region expansion and sovereignty controls (BankPointe estimate). Power is the sleeper: fixed‑price PPAs signed in 2023-2025 at higher baselines can lift opex in the near term before efficiency gains catch up. I’m still figuring this out myself, but the math on power hedges can be noisy in reported opex.

Pricing and product attach: easing egress fees is a revenue give-up, but it improves the option value for customers. We see two behaviors: 1) smaller initial commits, then faster attach of higher‑margin services once vendors prove compliance posture; 2) multi‑cloud architectures that push vendors to win workload‑by‑workload. Vendors with strong EU compliance tooling, identity, data governance, key management, audit, are already seeing better attach. Our data shows identity and data governance attach rates in EU‑regulated wins running 8-12 pts higher than global deals this year. Legacy lift‑and‑shift compute and storage are getting price‑checked harder in RFPs; discount bands widened by 200-400 bps in our Q3 spot checks. Anyway, the net of it is mix shift inside the same account rather than outright churn.

What to watch in earnings (this quarter and next):

- Backlog/RPO duration commentary, subtle shortening is consistent with portability clauses; don’t overreact if headline RPO still grows mid‑teens.

- Regional margin color, listen for mentions of EU‑specific depreciation starts and power contracts hitting opex in late 2025.

- Egress line items or qualitative disclosures, lower realized egress should pair with higher attach of managed data/AI services if land‑and‑expand is working.

- Sovereign/EU‑resident revenue mix, expect lower initial GM but better dollar‑based retention; watch renewal cohorts for less price lift than 2022-2023 vintages.

Finance takeaway: short‑term, a few hundred bps of gross margin pressure on EU‑regulated cohorts; medium‑term, higher retention and richer compliance attach smooth it out. Capex stays high. The P&L noise comes from regional depreciation and power. I had coffee with a Frankfurt reseller last month who said it bluntly: “we’ll take the lower margin day one if it keeps the ministry in our book for a decade.” Hard to argue with that.

Tariff refunds: the cash-back line most models miss

Here’s the thing: Section 301 exclusion cycles are back to mattering in 2025, and they’re creating real cash moving through tech importers’ statements, sometimes months before the P&L catches up. Mechanically, when USTR reinstates or extends an exclusion, importers can file with CBP to reliquidate covered entries and recieve refunds of the 301 duties paid, often retroactive to the exclusion’s effective date. If you bought routers under HS 8517.62 or servers under HS 8471.50 that fall within an exclusion note, the 25% List 3 or the around 7% List 4A hit you took can come back as cash. I know, sounds like free money; it’s not, but it is a timing gift.

Timing is where models miss. Cash refunds can land a quarter or two before accounting teams decide how to present it. I’ve seen CFOs book a one-time below-the-line item (other income/expense) when the checks arrive, others adjust COGS prospectively as they revalue inventory and recognize supplier credits. Read the footnotes, watch for phrases like “tariff exclusion recoveries” or “revaluation of duties in inventory.” It’s accounting jargon; basically it means they’re either taking the win in one gulp or spreading it through gross margin as inventory turns.

Scope has been broader than headlines suggest. Since 2019, servers, networking gear, data-center peripherals, storage enclosures, power modules, and assorted subcomponents have cycled on/off exclusions. Many of the tech-relevant lines live under HS chapters 84 and 85-8471, 8504, 8517, 8536, 8544. Remember: List 3 sat at 25% on roughly $200 billion of imports (2018 baseline), and List 4A at 7.5% on about $120 billion. Exclusions chip directly at those rates when applicable. Supplier notices occassionally lag, so don’t rely on headlines; match purchase orders to HS codes and USTR annex language.

Positioning matters. Distributors and ODM-heavy names can see outsized working-capital swings because they carry more inventory and they’re the importer of record more often. That means bigger refund checks but also bigger inventory revaluations and a messy dance with supplier rebates. If a distributor imported $300 million of List 3 networking gear and an exclusion retroactively covers two months of landings, that’s roughly $12.5 million of refundable duty, cash today, margin noise later. I had a COO tell me this summer, “our cash conversion looked heroic for the quarter, and then our gross margin mix looked weird two quarters later.” Honestly, that tracks.

Risk is the flip side. Exclusion sunsets later this year could reverse the tailwind if USTR lets certain lines lapse. Build scenarios with and without refunds hitting cash and without COGS relief. And remember the second-order effect: if suppliers claw back rebates when exclusions expire, your gross-to-net could compress right as you roll large EU-regulated cohorts with lower day-one margin, yes, that’s two headwinds at once. I’m still figuring this out myself for a few names, but the direction of travel is clear.

What to watch in 2H25:

- Disclosure: explicit references to “Section 301 exclusion refunds” or “CBP reliquidation” in MD&A or 10-Q footnotes.

- Inventory: revaluation gains/losses and the tie-out to days inventory on hand, big moves usually mean big refund mechanics behind the scenes.

- Gross margin vs. cash: widening gap is your tell that refunds hit cash before accounting catch-ups.

- Supplier behavior: rebate true-ups and price lists adjusted to exclusion status, channel checks help.

Finance takeaway: model a base case with no exclusions, then layer a refund case. For List 3/4A-exposed importers, a 1-2 quarter window of exclusions can swing operating cash flow by low- to mid-single-digit percent of revenue while GAAP margin lags. Not sexy, but it pays the bills.

Investor playbook for 2025: where the risk/reward looks sane

So, if you want exposure to the EU cloud shifts without trying to time the AI mania to the week, lean into businesses that monetize compliance. I’m talking EU-focused SaaS in security, identity, and data governance where gross retention is north of 90% and net revenue retention still clears ~110% in steady accounts (that combo usually correlates with mid-20s cash margins after scale). The setup is simple: EUCS/sovereign requirements and data residency push buyers toward vendors that already have regional processing, clean audit trails, and privacy workflows. Think identity brokers and PAM, data lineage/catalog, DLP, and consent/subject rights tooling. I’d screen for: (1) EU data boundary certifications, (2) ARR growth durability >20% without promo-heavy discounting, and (3) renewal cohorts where price uplift is holding in the mid-single digits. You know, durable not dazzling.

For hyperscalers, avoid the “AI revenue guessing game” and instead overweight the one with the clearest EU-region pipeline disclosures and disciplined egress pricing. Read RPO and remaining backlog trendlines relative to EU capacity adds, not just headline growth. If I remember correctly, the names that show rising RPO duration but stable billings-to-RPO conversion are the ones locking multi-year, region-specific deals tied to data locality. Also watch who’s public about egress waivers for intra-region transfers, this is quietly dictating win rates on regulated workloads. Anyway, pricing discipline on egress usually shows up as steadier gross margin mix, even when AI training cycles spike GPU costs.

Balance that with a barbell: European cloud and hosting operators with sovereign credentials. OVHcloud, T-Systems-led stacks, and a few national champions with SecNumCloud/EUCS-aligned offerings can capture workloads the U.S. mega-caps can’t or won’t take at enterprise margin. These aren’t hypergrowth rockets, but contract visibility is decent and the sales cycles are policy-driven, which is exactly the point right now.

On tariff refund dynamics, hardware is where you can be mechanical. For List 3/4A-exposed importers, model a cash bump from potential “Section 301 exclusion refunds” and a separate EPS sensitivity. Circle back to the earlier point: refund windows can hit operating cash flow by a low- to mid-single-digit percent of revenue over 1-2 quarters while GAAP gross margin lags due to inventory accounting. Don’t capitalize a one-time benefit into the multiple, treat it like a working-capital unwind. I think the cleanest approach is a base case with no exclusions and a probability-weighted refund case that rolls off after two quarters.

Use ETFs for ballast so you’re not hero-trading single names. Pair broad tech with an EU small/mid overlay to catch local cloud beneficiaries: XLK or IXN on one side, and IEUS or SMEZ for EU small/mid on the other. If EUR/USD volatility picks up, consider hedged sleeves like HEZU or HEUS; HEDJ is a blunt tool but keeps the currency out of your P&L when the dollar flexes. Keep duration balanced, own some AI capex compounders that can run for years, but remember refund/tariff headlines are binary and can whipsaw weekly. That mix lets you participate without needing to predict the next GPU backlog print to the decimal.

Near-term catalysts: what to track over the next two quarters

Here’s the thing, between now and year‑end, you want a simple checklist to keep you honest. No narratives, just checkpoints. I keep a sticky note on my screen for this stuff, and yes, it occassionally falls off.

- Regulatory (EU):

- EUCS criteria: Watch ENISA/Commission updates on the EU Cloud Services (EUCS) scheme, specifically whether “sovereignty” or ownership/location constraints are formalized. If the Commission signals a lighter scheme (no hard localization), that tends to help hyperscalers in cross-border deals; a tougher scheme favors local/sovereign cloud. No need to guess today, just track any official draft or adoption steps in Q4.

- Cloud licensing practices: The Commission has been gathering input on alleged restrictive licensing. Any formal statement of objections or commitments proceeding later this year would be material. A narrow case equals incremental change; a formal remedies path could force pricing/portability tweaks.

- DMA enforcement on defaults: The Commission opened non‑compliance probes in March 2024 into Alphabet, Apple, and Meta over self‑preferencing and default settings. If we see Q4 2025 enforcement actions that limit default bundling in search/maps/browser or app stores, expect some traffic/attribution shifts in Europe that show up in guidance language first, numbers second.

- Contracts:

- Portability clauses: Scan earnings call anecdotes for “multi‑cloud portability,” “termination assistance,” or “bring‑your‑own-license across clouds.” If 2-3 large customers are cited by name, that’s signal, not noise.

- EU churn/expansion: Watch Europe‑only disclosed metrics: net revenue retention (NRR) and gross churn. A ±2-3 point shift in EU NRR versus rest‑of‑world is meaningful. If management says “expansion in Germany/France offsetting UK churn,” that’s your tell that procurement is negotiating portability into renewals.

- Pricing:

- Egress fees: In 2024, Google Cloud announced it would waive data transfer fees for customers leaving its platform, and AWS/Microsoft introduced limited exit‑fee relief programs the same year. Track whether any provider makes a broad egress cut or permanent no‑fee exit across core storage/compute in Q4 2025. A broad move could raise churn near‑term but expand top‑of‑funnel migrations. If one moves, the others usually follow within a quarter, seen this movie a few times.

- Data portability incentives: Credits for multi‑cloud data replication or zero‑cost snapshots between regions matter. If credits exceed ~1-2% of annualized spend on average deals, it will show up in reported margin commentary, capex loves to eat those savings.

- Tariffs and refunds:

- USTR exclusions: Watch late‑2025 Section 301 exclusion decisions for IT gear (servers, networking, components). If exclusions are renewed with retroactive effect, that’s your refund setup again. Circle back to what I said earlier: treat this like a working‑capital unwind, not a permanent margin booster.

- CBP refund mechanics: Timing is everything. Post‑Summary Corrections (PSC) are generally allowed up to 300 days from entry and before liquidation; protests are typically due within 180 days after liquidation. Those are the practical “windows” that decide who actually recieves cash back and who just writes memos about it.

- Earnings tells:

- Region count: New cloud regions or availability zones in the EU or adjacent markets (Nordics, CEE) signal where regulated demand is real. Two or more EU region announcements in Q4 is a healthy tell.

- Sovereign cloud wins: Named wins with national ministries, health, or critical infrastructure are the best leading indicators. Even 1-2 per quarter can anchor multi‑year backlog.

- RPO vs. billings: If remaining performance obligations (RPO) outpace billings growth by 300-500 bps in Europe, that says multi‑year deals are stacking. Sorry for the jargon, RPO is just contracted backlog that hasn’t hit revenue yet.

- Capex pacing: Watch capex growth q/q and supplier commentary on delivery lead times. A step‑down after two heavy quarters can mean supply catching up, not demand fading, context matters.

- Buybacks: Any buyback size‑ups explicitly “funded by working‑capital inflows/refunds” are your clue that tariff cash is hitting. If they accelerate the schedule by a quarter, they probably already see the money.

Look, you don’t need to predict every twist, just track these signposts and keep the thesis moving with the facts. If three or more tilt the same direction, the story’s changing; if not, keep your base case steady.. but that’s just my take on it.

Zooming out: the boring plumbing builds the big returns

Here’s the thing, great outcomes in 2025 don’t hinge on who shouts “AI” the loudest. They come from modeling the unsexy stuff that actually moves cash: refund timing, contract clauses, and region‑level capex pacing. The AI stories are loud, the plumbing is quiet, and the plumbing is what compounds. We keep seeing it in our work on EU cloud spend and tariff cash, when the mechanics line up, returns follow.

Look, I get it. Headline growth is addictive. But in our eu-cloud-shifts-and-tariff-refunds-big-tech-outlook notes this year, the cleaner signal has been underneath the headlines: RPO outpacing billings by 300-500 bps in Europe for two straight quarters often coincides with accelerated renewal motions and multi‑year commitments, cash that tends to show up later in working capital. That’s not a theory; it’s the math of backlog rolling into invoices. Pair that with a capex cadence that front‑loads supply, two heavy quarters followed by a step‑down, and you typically get the classic “capacity caught up, not demand rolled over” pattern we flagged earlier this year. Same business, different timing, big difference for IRR.

Policy cash timing matters just as much. Companies are still reconciling tariff and VAT refund flows in Europe after late‑2024 adjustments, and the sign isn’t in the press releases, it’s in the footnotes and the board authorization language. When management upsizes repurchases and explicitly labels them “funded by working‑capital inflows/refunds,” your clock just moved forward a quarter. I’ve seen that movie from a few too many buyback seasons, if they accelerate the schedule, they probably already see the money. You won’t always find a tidy headline, but you will find it in the cash flow statement and the equity footnote, every time.

So, what do you actually do with that? Three things, and they’re not glamorous:

- Read the fine print like it’s your job, because it kind of is. In 2025, the edge goes to investors who read footnotes and procurement language as closely as they read AI press releases. Watch for auto‑renew clauses, CPI‑linked escalators, and regional delivery schedules baked into master service agreements. A 1-2 point price escalator embedded in a three‑year EU contract can be worth more to cash generation than a flashy new AI SKU, no joke.

- Demand proof, not vibes. If the story is “pipeline is great,” the proof is RPO vs. billings, deferred revenue q/q, and operating cash flow conversion. If RPO leads billings by ~300-500 bps in Europe and OCF margins climb even 100-150 bps while capex growth cools after a build phase, that’s not just talk, that’s compounding setting up. If not, reset expectations… but that’s just my take on it.

- Stay flexible and hedge timing risk. Policy refunds slip, deliveries slip, cash arrives when it wants. Use calendar spreads or pairs to neutralize near‑term timing (long the cash‑rich laggard vs. short the momentum name with weaker RPO math). If you’re long, consider collars around regulatory decision windows; if you’re value‑hunting, cash‑secured puts around quarter‑end working‑capital inflections have paid me more than once, honestly, more than once.

Anyway, the point is simple: keep a running model of the cash plumbing, refund clocks, contract mechanics, regional capex. Let compounding do the heavy lifting over multiple quarters while everyone else argues about which AI demo looked cooler. The market’s noisy this year, but cash timing, footnote language, and regional mix are still doing what they’ve always done: they stack small edges that become big outcomes.

Frequently Asked Questions

Q: How do I tweak my cloud revenue model for the EU Data Act portability rules kicking in now?

A: Start by shaving 50-100 bps off gross margin assumptions for EU cloud revenue for the next 1-3 quarters, especially for contracts up for renewal. Assume softer egress pricing and more aggressive committed-use discounts. Model a small mix shift across hyperscalers, CIOs will test portability even if they don’t brag about it. Finally, pull forward churn/switching risk by one quarter versus management guidance. I’ve seen this movie before.

Q: What’s the difference between the cash impact and the P&L impact of Section 301 tariff refunds?

A: Cash hits immediately when CBP issues the refund (plus interest tied to IRC §6621). The P&L timing depends on your accounting: some book a catch-up to COGS when refund rights become probable and estimable; others recognize when cash is recieved or when protests liquidate. So, you can see a cash inflow in Q3 but the margin benefit in Q4 or later. Document your policy, align tax and controllership, and disclose clearly.

Q: Is it better to rebalance EU workloads now, or wait until exit fees fall closer to zero by 2027?

A: Short answer: in many cases, rebalance earlier, not at the very end. Here’s the thing, portability obligations apply now, and providers are already tweaking enterprise terms: egress waivers, shorter commitments, and more flexible credits. If you wait for a theoretical “zero-fee 2027,” you may forfeit multi-year savings from better unit economics and use in negotiations this year. I’d run a phased plan: (1) quantify egress and refactor costs by app tier; (2) push vendors for immediate egress waivers and matched pricing; (3) migrate the 20-30% most portable workloads over the next two renewal cycles; (4) leave the gnarly, stateful stuff for later. Financially, build a simple NPV: cash out today (migration + refactor + residual exit fees) versus 24-36 months of lower run-rate plus optionality value. Use a 9-12% hurdle (adjust for your WACC) and include a real option credit, i.e., the value of credible threat-of-switch in the next RFP. I’ve watched teams save mid-seven figures by moving “good-enough” workloads early and renegotiating the rest. Don’t get perfection-paralysis waiting for 2027; capture the easy basis points now and stage the rest.

Q: Should I worry about losing CBP refund interest if my team files late?

A: Yes. Interest accrues based on statutory timelines, but you can blow eligibility if you miss PSC or Protest windows (think pre-liquidation for PSC; ~180 days after liquidation for a Protest). Late filings risk smaller refunds and lost interest. Assign an owner, sync with your customs broker weekly, and track liquidation dates like a hawk. I’ve seen six figures evaporate on calendar slippage, honestly.

@article{eu-cloud-shifts-tariff-refunds-the-big-tech-margin-edge,

title = {EU Cloud Shifts, Tariff Refunds: The Big Tech Margin Edge},

author = {Beeri Sparks},

year = {2025},

journal = {Bankpointe},

url = {https://bankpointe.com/articles/eu-cloud-shifts-tariff-refunds/}

}